How to pay bills with Peakflo?

There are a couple of ways to pay bills with Peakflo:

Make sure that your bill has been approved for payment before proceeding with the steps!

Pay an individual bill

Automatically, a bill that is approved will be moved to the Approved tab under Bills.

Pay now

If you want to pay the bill right away, click on a bill. When "Actions" shows up, click "Pay Now".

Note that payment will be made using the Peakflo wallet, so ensure that it has sufficient funds. If not, Peakflo will send you an email notifying payment failure along with the amount to top-up your wallet.

Change the payment date

If you want to change the payment date, click on a bill. Then, select "Change payment date"

Then, set the payment date.

Mark as paid

Let's say you have made a payment against a bill outside of Peakflo. You'll need to mark the bill as paid manually.

You can also check the payment method in the timeline of the bill.

Pay bills in bulk

Do you have multiple bills you want to pay in one go? That's the cool thing about Peakflo - see how you can conduct mass action on multiple bills.

Cross-Border Payout

1. Set Up Bank Details for Vendors

Once you have successfully enabled cross-border payments, the next step is to configure vendor bank account details for cross-border payments.

1. Go to "Vendors" under "Payables" section. Locate the vendor for whom you want to set the bank account details and click on the pen icon to edit.

2. Once the pop-up appears go to the "Bank Details" tab. Fill in the details like in the image below.

When you create a vendor bank account, a payment beneficiary is simultaneously established. It is important to note that the required beneficiary details may vary depending on factors such as the bank's country, the beneficiary's country, the currency being used, and whether the entity is an individual or a business.

2. Set Up Payment Details in Bills

When creating a bill in Peakflo, be sure to set the cross-border field values appropriately.

-

Payment Channel: The payment channel represents the method through which funds will be transferred from your account to the vendor's bank account.

-

Purpose of Transfer: The purpose of transfer is a critical component that defines the reason for the payment.

We enable cross-border payments under the following conditions:

- The bill currency and wallet currency are the same, but the receiver's currency differs.

- The bill currency and receiver's currency are the same, while the wallet currency differs.

Once the payment date arrives, the bill will be automatically disbursed, and the relevant details will be displayed in the bill details pop-up.

Should a payment fail, an error message will appear in the user interface, and an email notification will be sent to both the finance team and the bill creator.

FAQ

Will vendors get notified about the payment?

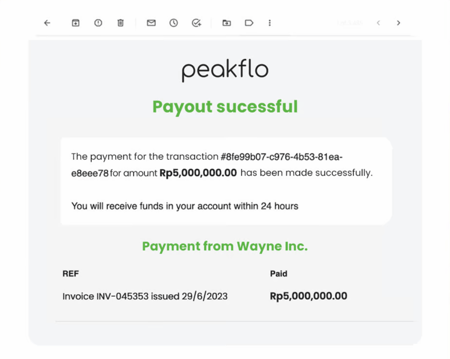

To keep your vendors in the loop, we will send them an email to inform them that the payment is successful along with the receipt.

The following is a preview of the email notification that will be sent.

The following is a preview of the receipt PDF that will be attached to the email. It will include your Company Name and the Payment Partner details.

How do I know if a payment is successful?

You can track your payment status in the Bills & Reimbursement tab. If it's successful, it'll go to the Paid tab. If it's unsuccessful, it'll go to the Failed tab.

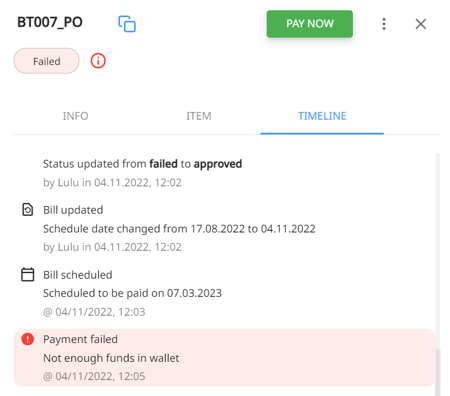

If you'd like to know why the payment failed, you can go to the Timeline.

Here's a quick rundown on payment failure possibilities along with the solutions:

| Payment Failure Code | Resolution |

| Not enough funds in your wallet | Please top-up your wallet to continue the payment. |

| Payment not configured | Please contact support@peakflo.co |

| Missing vendor details | Please complete the bank details of said vendor. |

| Invalid vendor details | An invalid or blocked bank account could be one factor. Please check and correct the bank details of said vendor. |

| Encountered error when processing the transaction | Please try again after 1-3 hours. |

| The amount is below the minimum value required | Increase the amount to meet the minimum required for successful disbursement. |

| Swift code is not valid | Recheck and make the necessary corrections for Swift Code. Learn more about how swift codes work in our create and upload bills guide. |

| Bank account mismatch or Swift code mismatch |

Go to Vendor > Edit icon > Bank details. Make the necessary corrections, then save and reschedule the payment. |

| Wallex service unavailable, please retry later | Try again in some time. |

| Amount exceeds upper limit (1500000 INR) |

Payment should be within limits for INR

|

| Amount is less than limit (500000 IDR) |

Payment should be within limits for IDR

|

| Amount is too small |

Payment is smaller than the fee

|

| Not enough funds in wallet | Top up wallet. |

| Invalid purpose of transfer |

Select the correct purpose of the code

|

| Beneficiary is not created in Wallex |

Please check the bank details entered

|

| Issuer Gateway is not Wallex | Contact peakflo |

| Unable to resolve WALLEX calls | Contact peakflo |

| Unable to create beneficiary |

Please check the bank details entered

|

| BIC_SWIFT_CODE_INVALID_COUNTRY | An issue in Swift code. Recheck and make the necessary corrections for Swift Code. |

| INVALID_BENEFICIARY_CITY | Recheck and make the necessary corrections for beneficiary city. |

| INVALID _BANK_ACCOUND_HOLDER_NAME |

Recheck and make the necessary corrections for Account holder's name.

|

| BENEFICIARY_VALIDATE_STATE_REGION_FAILED | Recheck and make the necessary corrections for the region. |

| INVALID_BENEFICIARY_ADDRESS |

Recheck and make the necessary corrections for the beneficiary address.

|

| COUNTRY_INVALID |

Recheck and make the necessary corrections for the beneficiary country.

|

| INVALID_REGION | Recheck and make the necessary corrections for the region. |

| INVALID_BANK_ACCOUNT_TYPE |

Recheck and make the necessary corrections for the bank account type.

|

| INVALID_BIC_SWIFT_FORMAT | Recheck and make the necessary corrections for Swift Code. |

| INVALID_BENEFICIARY_COMPANY_NAME | Recheck and make the necessary corrections for the company name. |

| INVALID_ACCOUNT_NUMBER_FORMAT |

Recheck and make the necessary corrections for the account number format.

|

Why did FPX payment failed?

Financial Process Exchange (FPX) is a Malaysia-based payment method that allows customers to complete transactions online using their bank credentials. The following are the possible scenarios when FPX payments could fail:

- User bank account FPX limit setting, e.g. the transaction amount is RM3000.00, but the user setting with their respective bank is RM1000.00 - thus, no matter how many times the user try, it will not work, and many users don't know their limit set by the bank.

- User did not complete the bank side authentication, e.g. OTP or notification, or bank side fail to send notification (app notification turned off so user didn't get notification).

- If user is paying using a corporate/company bank account, the user initiate the payment via FPX, it will be "pending" until the checker logs in to the bank side to approve the transaction. So in this instance it will always "fail" and be stuck at pending.