How to issue a tax invoice (GST invoice) in Peakflo?

Companies in Singapore require tax (GST invoice) invoices. Follow the steps in this article to learn how:

At the time of Peakflo account setup, depending on your invoicing requirements and company location, the Peakflo team can set up and customize your invoices. Please contact support@peakflo.co for more details.

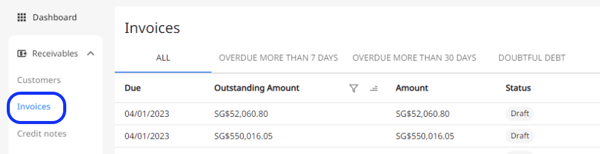

1. Go to the "invoicing" tab under the "Receivables" section.

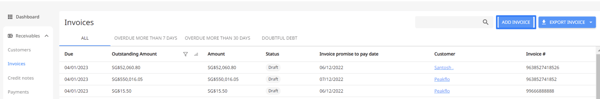

2. Then click on "Add New". For issuing an invoice, please check out this link.

3. Once the invoice is issued, you can send it for approval or share it with customers using automated workflows.

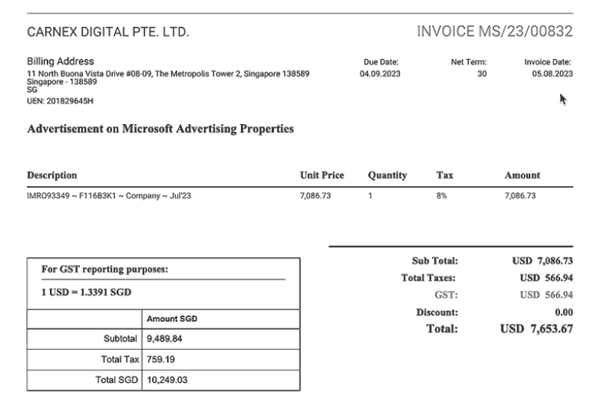

The tax invoice (GST invoice) will look like the example below once shared with your customers.

Peakflo now shows currency conversion when payment is created. Similarly, credit notes show currency conversion when applied to invoices. The finance team will have full visibility over the amount received in base currency using the correct foreign exchange rate.