How can vendors check receipt notes and issue invoices from the Peakflo vendor portal?

Vendors can check the receipt notes and issue invoices agains receipt notes in Peakflo vendor portal by following the steps below:

Your vendors can easily check the receipt notes in their secure and self-serve vendor portal and issue invoices against the receipt notes.

Once a vendor accepts an invitation to the vendor portal and connects to Peakflo, the software will automatically sync any open purchase orders with outstanding balances that were previously created against the vendor's account. After syncing the POs, the software will also sync the corresponding approved receiving notes to the vendor’s account.

For delivered goods, the invoice can be created via approved receipt notes to make sure the vendors are not under-delivering the items. Also, the invoice is according to the receipt notes and your vendors do not need to carry the burden of manual invoice issuance.

1. From the left navigation bar, vendors can go to the “Customer RN” tab under “Receivables”.

In this view, your vendors can see the RN status and which RNs are not billed.

Vendors can click on the filter icon on the "Bill Status".

This allows for filtering out the receipt notes by "Not billed", "Partially billed", "Fully billed", or "Over billed".

2. Vendors can click on the receipt note you’d like to check and from the receipt note window, you can see the receipt note “Info”. RN info contains the details regarding purchase amount, withholding tax, balance, date, issue date, delivery date, and approval policy.

4. To check the history of all the changes and communications regarding the RN, you can check the “Timeline” Tab. Leave comments for any stakeholder or point of contact to ask a question by clicking on “Write Comment”.

You can tag the stakeholders using @ and click on “write comment”.

The stakeholders will get notified immediately and will be able to check and respond to your comments.

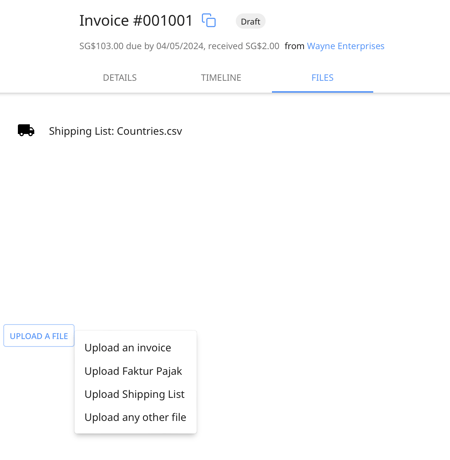

5. Your vendors can issue invoices against RNs by clicking on “Create Invoice”.

Here your vendors can check the details of the invoice, upload the necessary files, and send the invoice for approval by clicking the "Send for Approval" button.

For setting up approval policies, vendors can check out this link.

Peakflo vendor portal supports e-Meterai (Electronic Stamp Duty) and e-Faktur Pajak for Indonesia and Tax invoice (GST Invoice) for Singapore.

* The item unit price cannot be edited by the vendors at the time of invoice issuance to avoid overpayments.

* "Upload an invoice" is a mandatory attachment for the invoice to be approved. Without it, the invoice cannot proceed for approval.

* You can make certain file uploads mandatory for your vendors. In case the files are not uploaded, the vendors will receive an error and the invoice cannot be fully approved. (Please contact support@peakflo.co to make certain file uploads mandatory for vendors.)

* The custom field data will also get a pre-filled bill created from a receipt note.

* From the files section vendors can upload Shipping Lists which will go through an approval policy and will be scanned through OCR and matched with the invoice for validation by Peakflo. The validated invoice will be shown with a comment in the timeline

6. After the invoice is sent for approval, the approvers from the vendor company can review the invoice and approve it by clicking the "Approve" button or reject the invoice by clicking the "Return to draft" option from the three-dot icon.

7. Once the invoice is approved, the status of the invoice will change to "Due" which means the invoice is issued.

Once the invoice is in the "Due" stage, it cannot be returned to the draft for editing.

8. Once the invoice is issued, the invoice will be shown as a bill under “Bills and Reimbursements” under your “Payables” tab. Your procurement and AP team can check the invoice details and assign approval policies to the bills.

When performing bulk action to create invoices from receipt notes, be cautious not to select RNs from multiple customers. This is crucial to avoid confusion and ensure that the invoices are not mistakenly created from RNs belonging to different customers.