How to access e-Faktur Pajak and issue invoices?

The e-Faktur Pajak will be issued by the Indonesian Government and Peakflo can validate the faktur pajak with invoices for its clients. Check the article below to learn how:

At the time of Peakflo account setup, depending on your invoicing requirements and company location, the Peakflo team can set up and customize your invoices.

Please get in touch with support@peakflo.co to enable validation for e-Faktur Pajak.

Before we walk through how faktur pajak works, Peakflo can procure e-materai invoices for your company. See how e-materai works in this link.

Now let's see how Peakflo can validate the faktur pajak with invoices:

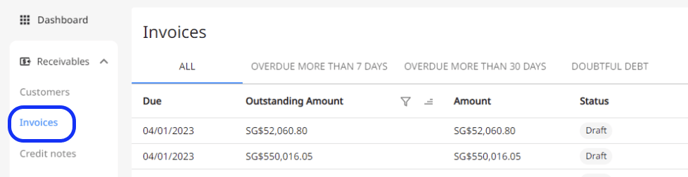

1. Go to the "Invoices" tab under the "Receivables" section.

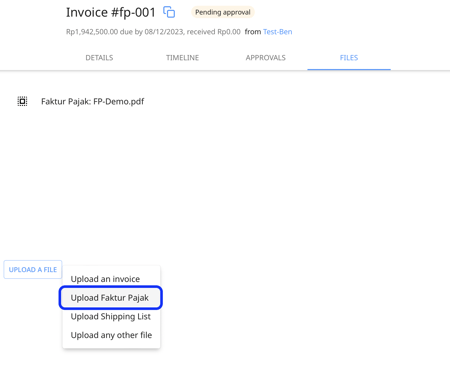

2. Open the invoice and go to the Files tab. Here you can upload the Faktur Pajak by clicking on the "Upload a File" option.

For best results, we recommend uploading the downloaded version of the faktur pajak, as scanned versions of the faktur pajak may not be captured accurately.

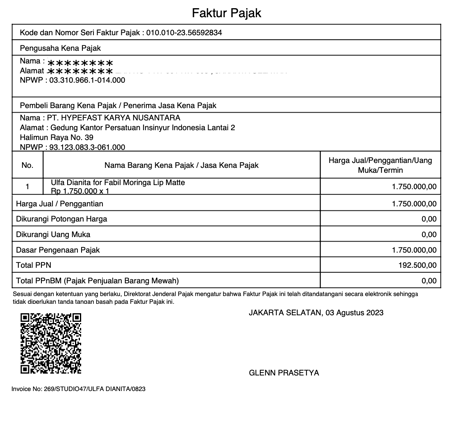

3. Peakflo will validate the Faktur Pajak with the invoice details before sending it to your customer. The e-faktur Pajak sent to your customers will be attached to the invoice like in the example below:

If a Faktur Pajak has been uploaded and the warning sign icon indicates an error stating that the "QR code not found", it may be necessary to re-upload the Faktur Pajak file with better quality.

Faktur Pajak date is also validated against the invoice issue date, along with other details. If the issue date and the faktur pajak date mismatch, then you will not be able to proceed with approval.

Listed below are some scenarios on how Faktur Pajak is validated:

Scenario 1: Faktur pajak pengganti

In scenarios when any changes are made to an active invoice, the invoice creator can issue a replacement faktur pajak, also known as "faktur pajak pengganti", with the same invoice number. When you add a faktur pajak pengganti attachment to an active invoice, the software will rerun validation checks for the attachment.

In such cases, Peakflo will proceed to validate the faktur pajak pengganti with invoices without matching the faktur pajak date and the invoice issue date.

If it passes the check, it will be added and synced to the customer's Peakflo system. If it fails, it won’t sync, and a note about the failure will be visible on the invoice timeline.

Scenario 2: Invoice with both taxable and non-taxable line items

In situations where an invoice includes both taxable and non-taxable line items, Peakflo will assess the subtotal of the faktur pajak against the combined subtotal of the invoice line items that are taxable. It will disregard any line items that do not include table line items in this comparison.

If the combined subtotal of the invoice line items that are taxable matches the subtotal of the faktur pajak, then the invoice will be validated and synced to the customer's Peakflo system.

If the combined subtotal of the invoice line items that are taxable does not match the subtotal of the faktur pajak, then the invoice won’t sync, and a note about the failure will be visible on the invoice timeline.

Scenario 3: Invoice subtotal 11/12 validation at the line item level

To ensure that the invoice 11/12 DPP amount is validated correctly and aligns with the DPP from Coretax, Peakflo applies the 11/12 validation on each invoice line item level. After calculating the 11/12 value for each line item, the decimal value is rounded. This rounding ensures accurate validation, preventing discrepancies and making sure the invoice can be successfully processed.

Scenario 4: DPP nilai lain & PPN amount tolerance

When a supplier uploads the Faktur Pajak, Peakflo will check the DPP Nilai Lain and tax amount (Jumlah PPN) line by line. A tolerance is applied during validation. This helps avoid errors caused by rounding differences. If the difference is within the allowed tolerance, no error will be shown. If it exceeds the tolerance, an error message will appear.

The invoice PDF will also include DPP Nilai Lain and PPN amounts so that you can compare those amounts when creating faktur pajak.

FAQ

How does Peakflo handle Faktur Pajak QR extraction and validation in Accounts Payable (AP)?

Here’s how Peakflo helps:

1. QR Code Extraction:

When you upload a Faktur Pajak file, Peakflo scans the new QR code format and extracts key details, including vendor name, NPWP, Faktur Pajak number, date, invoice subtotal, tax amount, and status.

2. Validation Rules

- Invoice Date Match → Checks if the Faktur Pajak date matches the invoice issue date.

- NPWP Check → Confirms that the NPWP in Faktur Pajak is correct.

- DPP Check (new rule) → From Jan 2025, Peakflo validates the new DPP = 11/12 of invoice subtotal (as per government regulation).

- Tax Amount Check → Confirms that the VAT (PPN 12%) is correctly applied on the new DPP.

- Faktur Pajak Status → Ensures the Faktur Pajak is approved and valid.