What is credit limit and how can I use it ?

Want to be able to automate customized credit controls for different customer categories? With Credit Limits, you can do just that.

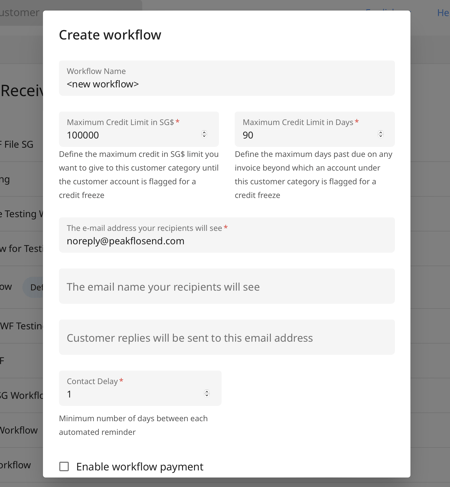

- When creating a workflow, you'll see the option to set credit limits: both financial and time.

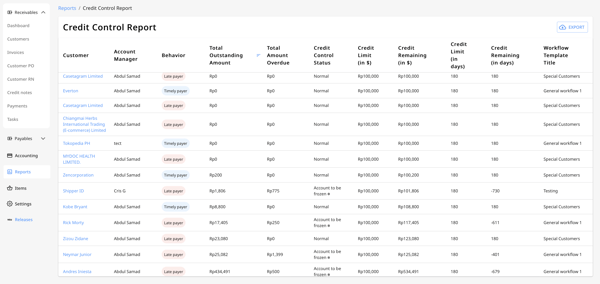

- You can also monitor the credit limits in the 'Credit Control Report', which you can find on the 'Reports' section.

Related Reads: How to create custom reports?

What if you don't want to use the credit limit feature?

If you don't want to provide credit limits to customers, that's cool: just set the credit limits high enough for it not to matter.

Credit limits are only for internal use and alarms will be triggered to internal stakeholders depending on when a credit limit (financial or days past due) is hit.