How to Add Tax Adjustments to Vendor Invoices in Peakflo?

To help vendors ensure accurate tax amounts for payments, Peakflo supports manual tax adjustments in vendor portal. This allows you to input a custom tax adjustment amount on top of the calculated tax. The adjustment is included in Faktur Pajak validation and is synced to your Peakflo accounts payable system.

To enable this feature, please contact support@peakflo.co

To add tax adjustments, follow the steps below:

1. Your vendors can navigate to the invoice they would like to adjust and click on the invoice to edit.

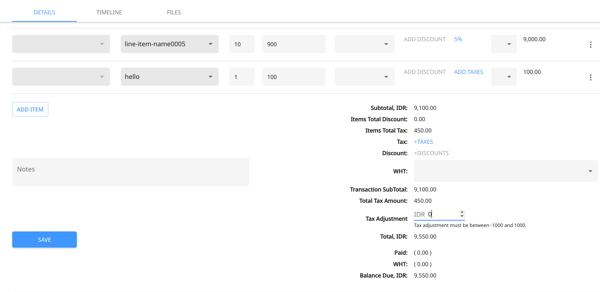

2. They can add taxes either at the line-item level or at the invoice level. Once taxes are selected, a new input field called "Tax Adjustment" will appear.

3. They can input the desired adjustment value in the Tax Adjustment field.

-

Your vendors can enter positive or negative values, up to 2 decimal places.

-

This value will be added to the total tax amount and used for validations.

4. If this invoice is sent to you, the tax adjustment will also sync to the your Peakflo AP system.