How split payments work in Peakflo?

Split payments in Peakflo work by automatically dividing incoming payments from customers and disbursing them to different recipients. In this article, learn how splitpament and split payout fees works.

Overview

Split payouts in Peakflo enable you to automatically divide incoming payments from customers and disburse them to different recipients. This feature is particularly useful for marketplaces, lending, and online travel businesses that need to allocate portions of their revenue to multiple parties, such as vendors or partners.

The split payout fee is the fee that covers the cost of transferring funds to the vendor's bank account and is deducted from the total payout amount before it is disbursed.

Table of Content

- How to set up a split payout?

- How will the split payment happen?

- How will the split payout fee be deducted?

How to set up a split payout?

1. Ensure that you have synced your vendors and their details, specifically bank account details, with Peakflo.

Check out the article, "How to add vendors in Peakflo?" to learn how you can add vendor details in Peakflo.

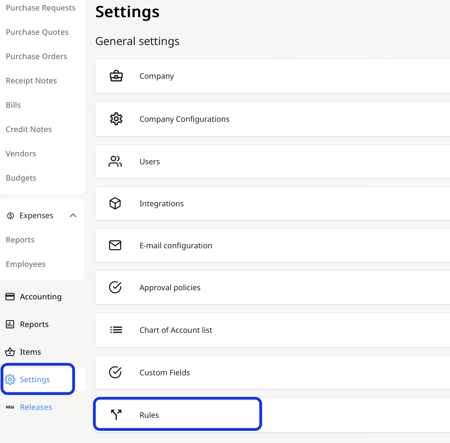

2. Now, go to "Settings", then click on "Rules".

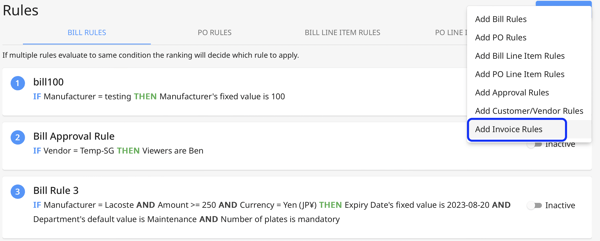

3. Click on the "+ Add Rule" button then select the "Add Invoice Rule" option.

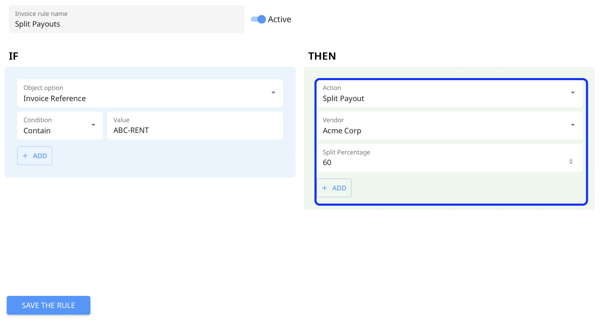

4. If you want to split payments then select the "Action" as "Split Payout". Also, add the vendor name to whom you want to disburse the payment under "Vendor" and then add the "Split Percentage".

For example, you want the make a split payout when the Invoice Reference contains the value ABC-Rent. Then you want to split the payment in such a way that the vendor gets 60% of the payment and you retain 40% of the payment. For such a scenario, the vendor invoice rule will be like the picture below.

To learn in detail how invoice rules work, check out the article "How to set up invoice rules?"

5. Click on "Save" to activate the rule.

How will the split payment happen?

Now that you have a split payment rule in place, check out the below steps to understand the split payout workflow:

-

When a customer pays an invoice, the payment is initially deposited into your Peakflo AR Wallet.

-

Then, Peakflo checks the invoice rules to determine if a split payout is applicable based on the invoice details.

-

If applicable, a percentage of the payment (let's say 40% as in the example above) is transferred to your designated bank account. The remaining percentage (i.e., 60% of the total transaction amount) is sent to your Peakflo AP Wallet.

-

Peakflo automatically generates a bill for the remaining percentage (i.e., 60% of the total transaction amount) against the vendor that needs to be paid.

-

Once the bill is approved and scheduled for payment, the specified amount is disbursed from your Peakflo AP Wallet to the vendor's bank account.

How will the split payout fee be deducted?

- When the transaction happens from Peakflo AP Wallet to the vendor's bank account, the payment processor charges a transaction fee.

- The payment processing fee is then deducted from the amount paid to the vendor.

- Finally, the vendor will receive, the split amount, minus the applicable fees.

Note: The split payout fee amount depends on the payment processor.