How to adjust the tax in Peakflo to match the exact vendor bill amount?

Peakflo supports a Tax Adjustment field that allows you to manually tweak the total tax to ensure the final bill total matches the amount shared by your vendor. This is especially useful if vendors apply custom rounding rules on tax.

Some vendors apply their own tax rounding logic, which can lead to small mismatches between the bill total in their invoice and what gets recorded in Peakflo. This causes confusion and extra back-and-forth when trying to reconcile amounts, especially for companies that want to match the vendor’s invoice amount exactly.

How does it work?

If you're experiencing small mismatches due to vendor rounding, enabling this feature can help reduce disputes and ensure payment accuracy.

To enable this feature for your account, please contact support@peakflo.co.

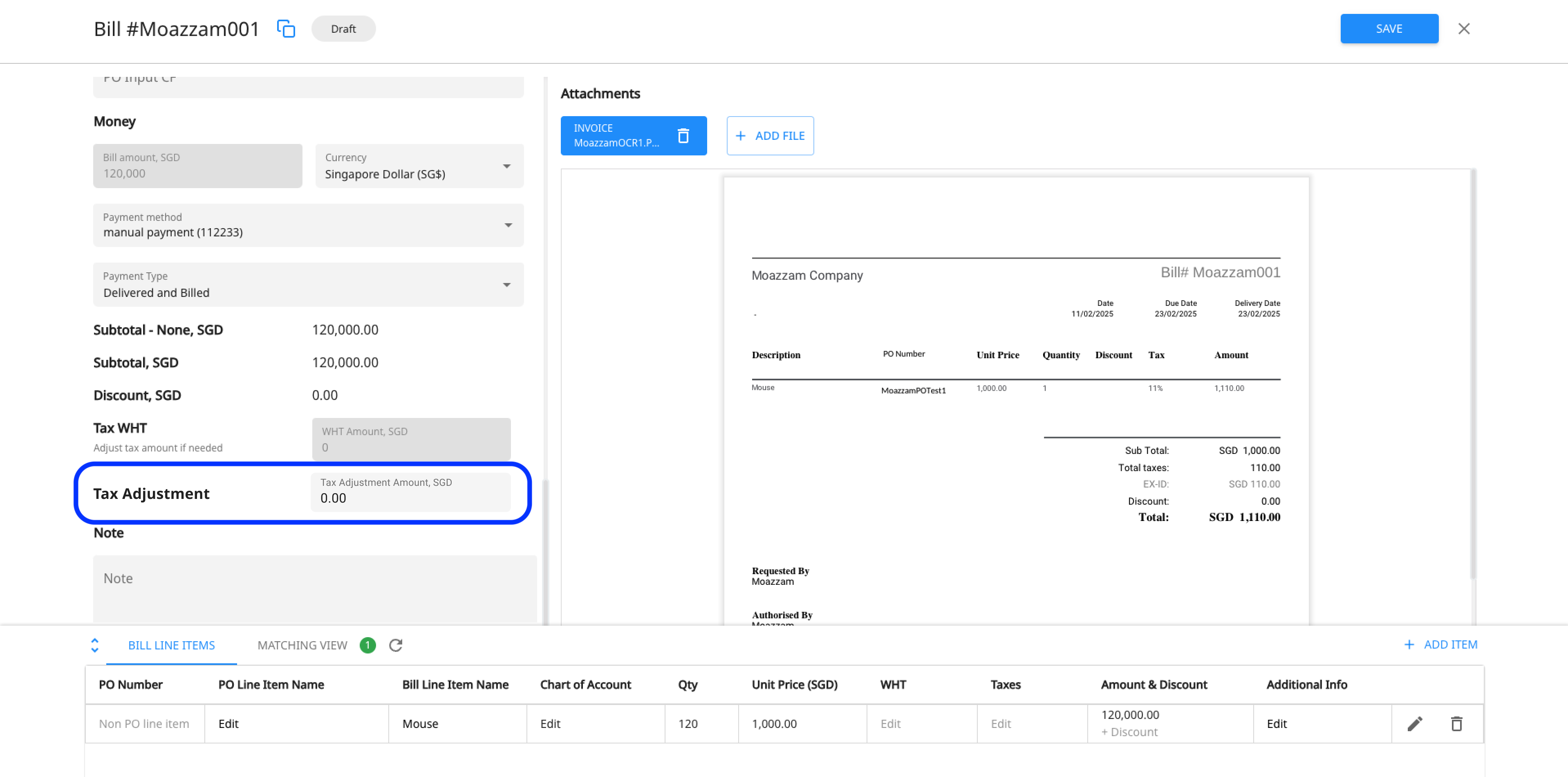

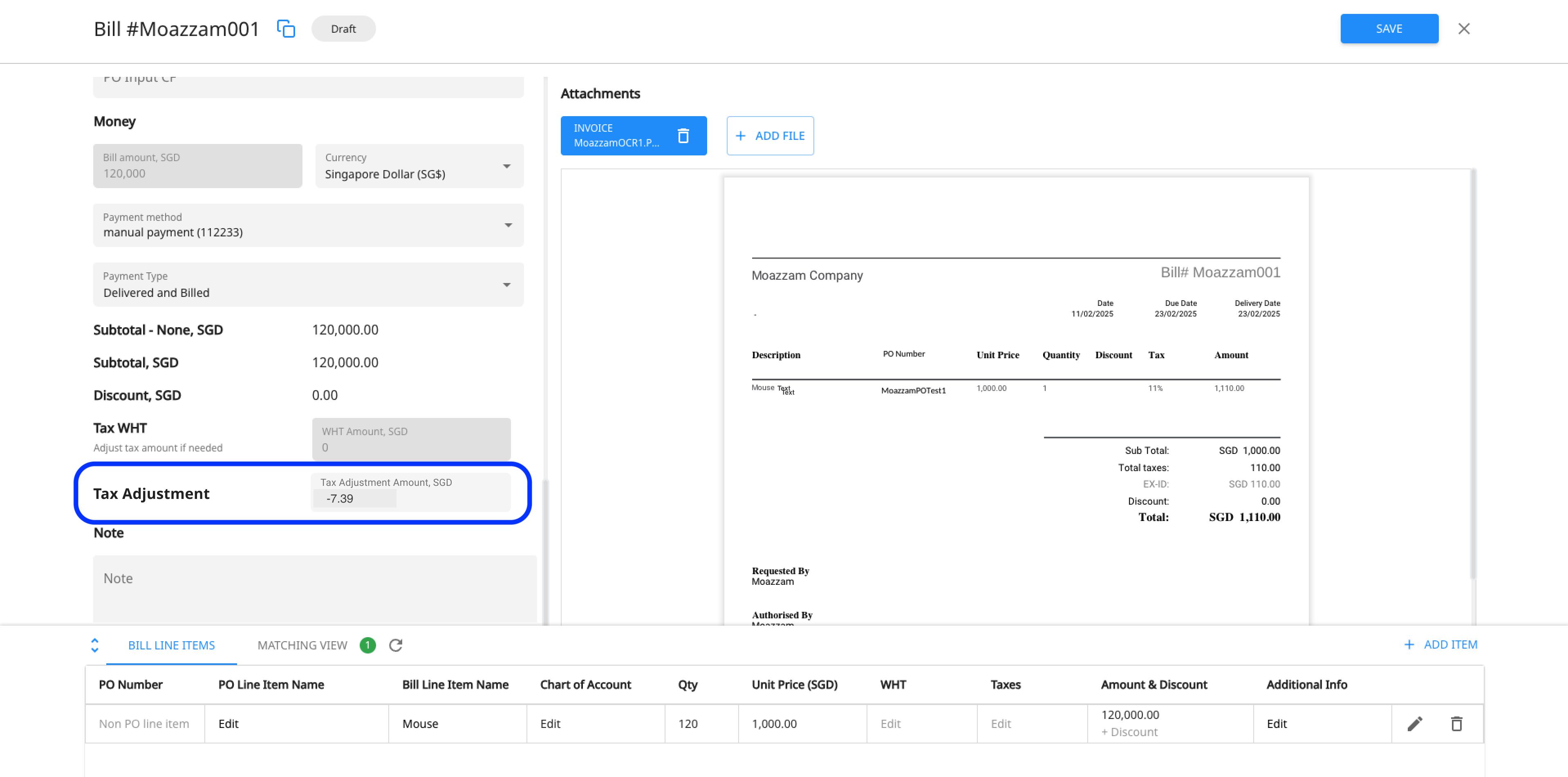

1. Open the bill window, and scroll down to the "Money" section. The “Tax Adjustment” field appears just below the total tax section.

2. You can enter a positive or negative adjustment (up to 2 decimal places) to fine-tune the total tax amount.

This adjustment value will be added to the total calculated tax across the bill line items. The final bill total will reflect this adjusted tax value, ensuring it matches the vendor's invoice.